Is Now a Good Time to Refinance Amidst Financial and Economic Crisis?

With the mortgage rates dropping in the recent weeks due to several financial and economic crisis (globally and nationally), we’ve been getting a flood of mortgage refinancing interests and applications.

Which brings about an important question …

Is now a good time to refinance your mortgage?

The market’s recent volatility amidst the global financial and economic crisis does not make that an easy question to answer.

If you’re in a fixed rate mortgage, keep in mind that fixed rate mortgage contracts have a penalty clause based on IRD (interest rate differential). The IRD penalty is based on the differential between your current contract rate and the new lower market rate.

If your fixed rate is over 3.09% there may be a good opportunity to save some money in the current environment. Otherwise, the penalty may offset any immediate savings from a lower fixed rate.

At Butler Mortgage, we can run an analysis and determine if it’s worthwhile refinancing now to a lower rate, at no cost to you. The following is a short list of information we will need to run the analysis:

- Penalty to break

- Approximate outstanding balance

- Exact maturity date

Questions To Ask Yourself Before Refinancing

If you’re still thinking that now may be a good time to refinance, first consider these two very important questions:

- How’s your credit? If your credit isn’t at the best it should to qualify for a lower rate, then holding off on refinancing might be prudent so you can work on better credit habits.

- How long do you plan to stay at your current home? You’d stand a greater chance of incurring great savings from paying less every month if you plan on staying in your home for awhile.

Refinancing typically requires several up-front costs, such as: getting an appraisal, closing costs, etc. Expect closing costs to total 2 percent to 5 percent of the principal amount of the loan.

While we all want a lower monthly payment to free up money for other expenses, renovations, investments, education tuition, auto loans… refinancing is not always the right choice.

Refinance With a Mortgage Broker

At Butler Mortgage, we absolutely stand by this statement: “If you are thinking about REFINANCING your mortgage, the right person to contact is a mortgage broker.”

We do a lot of the heavy lifting like researching your mortgage terms (many times people don’t understand the terms they have or have misplaced their documents), shopping and contacting multiple lenders on your behalf and do everything necessary to close the deal.

And, you don’t pay us to do any of those.

We have virtually unlimited access to leading financial institutions from across Canada. This guarantees you a huge range of mortgage options to choose from, so finding one that fits your needs precisely is simple.

We study rates daily and always know where to find the most competitive ones. Plus we know how to negotiate with lenders to ensure you’re getting the best available deal.

We find deals you can’t get anywhere else.

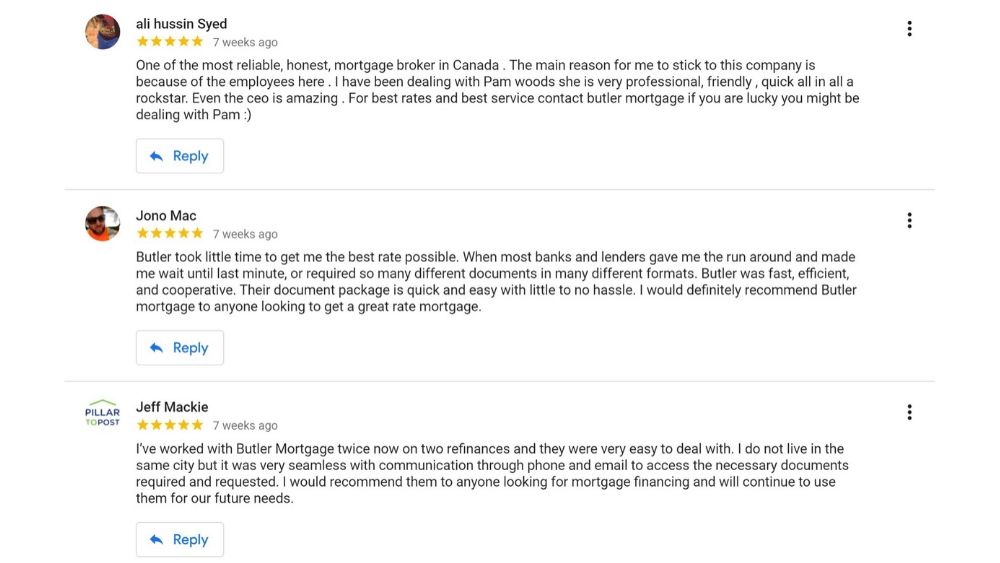

Read what recent clients have said about working with Butler Mortgage:

Get a Mortgage Quote (No Obligation)

At Butler Mortgage, we offer a no-fee, no obligation mortgage approval and mortgage quote that help simplify the entire process. We do a lot of the heavy lifting, shopping and contacting multiple lenders on your behalf. And, we can do all of this over the phone.

If you are in the market for a home purchase, mortgage renewal, mortgage refinancing, debt consolidation, CONTACT US any time and let’s start the discussion.

Leave A Comment